Cardiac surgeon Dr Devi Shetty’s Narayana Health group has applied for a license from the Insurance Regulatory and Development Authority of India (Irdai) to start a health insurance business. The group has established Narayana One Health and has appointed insurance industry veteran Ravi Vishwanath to lead it. Previously, Vishwanath was responsible for the health and accident businesses at HDFC Ergo.

Dr Shetty’s objective is to offer affordable coverage by reducing the cost of treatment in hospitals through economies of scale. His model proposes that insurance coverage be widespread so that the contributions of many can cover the costs of the few who require treatment. Currently, Narayana Health provides healthcare plans from a provider’s perspective, but health insurance would allow for comprehensive coverage without any limitations on providers or geographic areas.

According to the CEO of a private health insurer, the model of affordable health coverage through cheaper healthcare would be highly beneficial for the industry. Medical inflation tends to be higher than general inflation due to frequent advances in medical technology. Additionally, while health insurance increases the demand for healthcare services, it takes time to establish additional capacity to meet this demand.

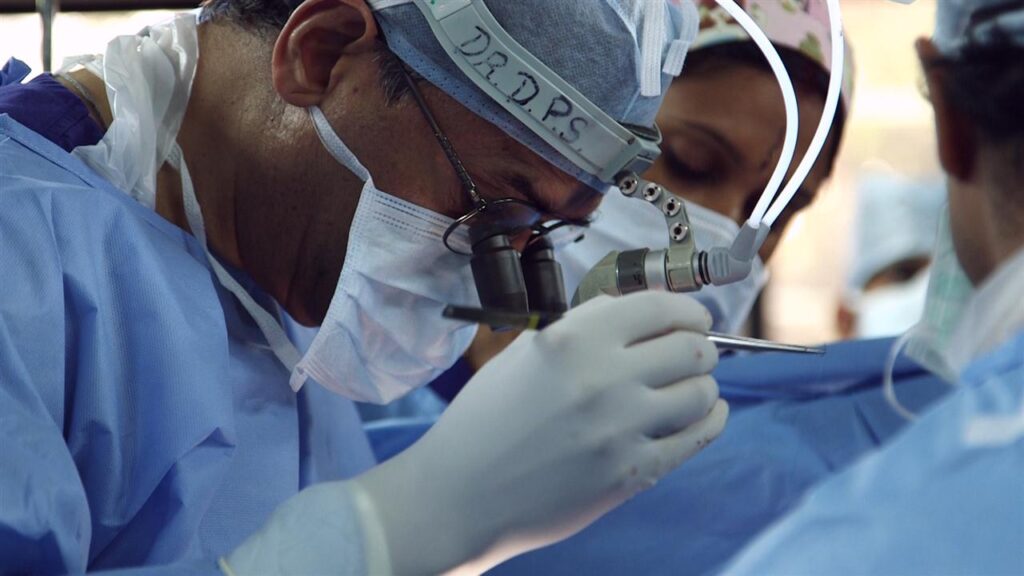

Dr Shetty, known for performing India’s first neonatal heart surgery and as Mother Teresa’s physician, founded Narayana Hrudayalaya in Bengaluru in 2001. His approach to achieving economies of scale in healthcare to reduce costs has earned him the nickname “Henry Ford” of heart surgery by the US media.

Hospitalisation coverage still dominates the health insurance market in India, and standalone health insurance companies have only been around for less than two decades. Currently, there are five standalone health insurance companies in the country, most of which operate by enrolling hospitals into a network to provide cashless claims service.